Misconceptions of Fed Rates vs. Mortgage Rates by David Cruz

When the Federal Reserve increases rates mortgage rates increase. Right? Wrong. This is a common myth. There is no direct relationship between the two. The Federal Reserve effects short term and adjustable rate mortgages such as the LIBOR and Prime Rate. Fixed rate mortgages are guided by the mortgage bond rate. More specific, the U.S. 10 Year Treasury Bond.

When Wall Street is in a bull market, it’s hard to attract investors away from high yielding stocks over to safer long-term investments such as U.S. Treasury Bonds. During these times, the U.S. Treasury increases bond rates to appeal to more investors. The increase of U.S. Treasury Bond rates leads to higher mortgage interest rates.

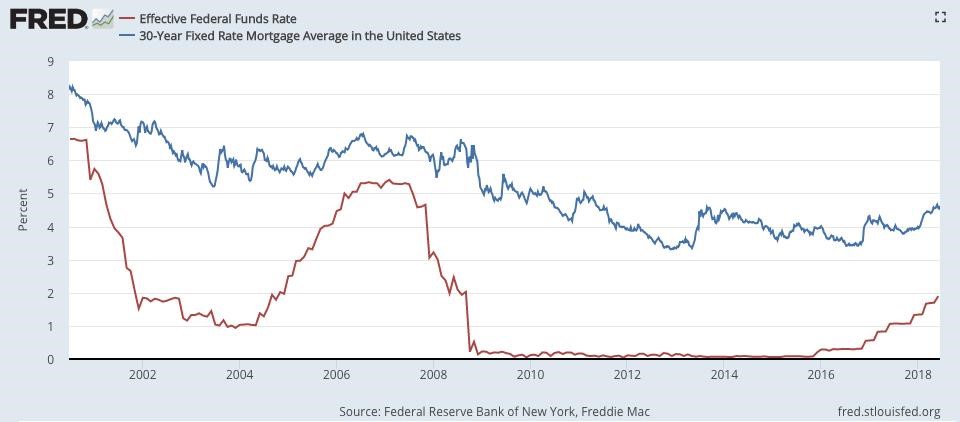

When Wall Street goes into bear market territory what’s happening is investors are moving their money into safer low risk assets such as bank CDs, Gold, and government-issued U.S. Treasury Bonds. Below is a chart that shows the history of the Federal Funds Rate and 30 Year Fixed Rate Mortgage Averages in the United States from 2000 – 2018.

It clearly shows that there is no direct relationship between the Fed Funds Rate movement and mortgage rates. There is one caveat to this long believed myth. Although the Fed Funds Rate doesn’t directly move the needle up or down on mortgage rates there is causation vs correlation. Fed Funds Rate is correlated with higher mortgage rates, but it doesn’t cause higher mortgage rates.

The 10-year US Treasury has historically been considered a reliable predictor of overall demand in the bond market. Why? Because it’s the law of supply and demand.

If the yield is low, people want safer assets and are buying more bonds, including mortgage bonds (Demand is high – usually when Wallstreet is in a bear market).

When it's higher, people are buying fewer bonds, which tends to correlate with higher mortgage rates (Demand is low – usually when Wallstreet is in a bull market).

This article was written by David Cruz who is the Branch Manager of Primary Residential Mortage in Miami. Below is a link to get in touch with him.